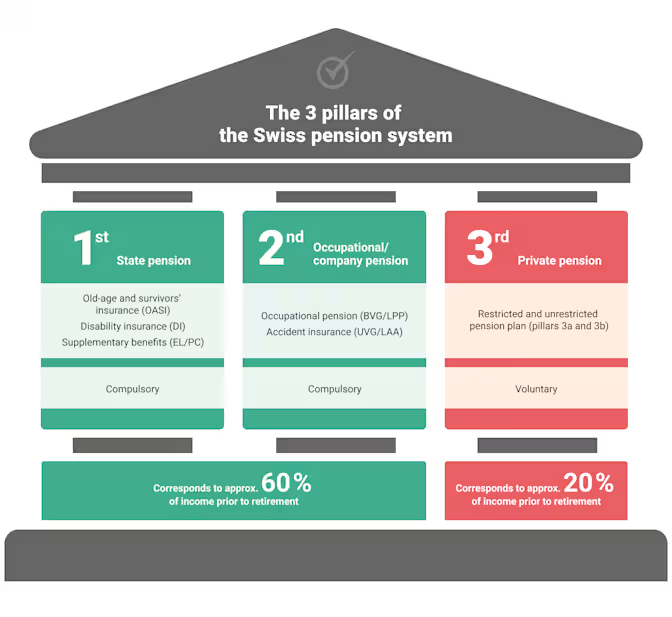

If you’re working in Switzerland and contributing to the social security system, you’ll come across the term “three-pillar system”. This structure covers retirement, disability, and survivors’ benefits. Here’s a breakdown of how it works and what matters most, especially if you don’t plan to stay in Switzerland long term. Given that most international organizations have their very own pension systems, the information in this article will most likely not apply to international civil servants.

Photo credits: Comparis.ch

First pillar: state pension (AVS/AHV/OASI)

The first pillar is a basic, mandatory state pension known as AVS (Assurance Vieillesse et Survivants) in French, AHV in German or OASI in English. It is designed to cover essential living costs in retirement.

Key facts:

- This is not an individual pension fund. It works as a redistribution system where current workers pay for current retirees.

- Contributions are automatically deducted from your salary and matched by your employer.

- Everyone who lives and works in Switzerland must contribute, including the self-employed.

- If you have years with no contributions, you may have “gaps” (known as holes), which reduce your future pension. These can sometimes be bought back under specific conditions.

- The pension is paid monthly starting at retirement age. There is no option to take a lump sum.

- This system does not apply to people working for most international organisations, who usually have their own separate pension schemes.

- If you move to a non-EU/EFTA country without a social security agreement, you can request a refund of your 1st pillar (AHV/AVS) contributions, forfeiting any future Swiss pension rights; if you move to an EU/EFTA country or a country with a social security agreement, your contributions are preserved for a future Swiss pension when you reach Swiss retirement age.

Second pillar: occupational pension (LPP/BVG)

The second pillar is a mandatory occupational pension for employees earning above a certain yearly income threshold.

Key facts:

- Contributions are automatically deducted from your salary, with your employer contributing at least 50 percent (sometimes more).

- The percentage of contribution increases as you get older, which makes hiring older workers more expensive for employers. This is one of the main reasons why it’s often considered difficult for older workers to find a job.

- The second pillar aims to maintain your standard of living in retirement and includes benefits for disability and death.

- When switching jobs, your savings are transferred to the new employer’s pension fund. If there’s a gap between jobs, the money is placed into a compte de libre passage (vested benefits account).

- You can withdraw part of your second pillar savings early to buy a primary residence in Switzerland.

- At retirement, you can usually choose between a monthly pension (paid for life), a lump-sum withdrawal, or a combination of both. The monthly pension is often preferred because it provides stable income for life.

- If you leave Switzerland permanently, you may be able to withdraw your second pillar, depending on your destination and whether you’re joining another pension system.

Third pillar: private savings (3a/3b)

The third pillar is optional and allows individuals to save more for retirement. It consists of two types: 3a (tax-advantaged) and 3b (often in the form of a life insurance, more flexible but without tax benefits).

Key facts:

- The 3a option is far more common than 3b due to tax deductions available on 3a contributions.

- Funds in a 3a account are typically invested, with restrictions on early access.

- Early withdrawal is possible only under specific conditions, such as buying a primary residence, starting a business, or leaving Switzerland permanently.

- If you don’t plan to stay in Switzerland long, the 3rd pillar often isn’t worth it. Withdrawals made after a short time may not yield strong investment returns (or potentially even lead to a loss), and you lose the long-term tax benefit. In such cases, investing the money yourself can make more sense, even without the same tax advantages.

Get personalized guidance

Select an option above to learn more.

📅 Arrange a callback

Pick a TimeClick the button above to pick a time that suits you. I will call you to discuss your request and outline how I can best assist you, entirely without commitment.